Garrett Announces Third Quarter 2018 Results

- GAAP Net Sales of $784 million, up 5%; 7% organic growth*

- Income before taxes of $73 million

- Adjusted EBITDA*of $137 million ($143 million ex-hedging impact*); Margin of 17.5% (18.2% ex-hedging impact*)

- NYSE trading began on Oct 1 and Garrett became an independent public company with decades of industry leadership and strong financial profile

- Issued $1.6 billion in new debt securities at a weighted average cost of 3.2%

ROLLE, Switzerland--(BUSINESS WIRE)-- Garrett Motion Inc. (NYSE: GTX), a cutting-edge technology provider that enables vehicles to become safer, more connected, efficient and environmentally friendly, today announced its third quarter 2018 financial results. The financial results are as of September 30, 2018 and presented on a carve-out basis derived from the consolidated financial statements and accounting records of Honeywell. Garrett Motion Inc., (Garrett), became an independent company as of October 1, 20181.

|

Q3 2017 |

Q3 2018 |

$ Millions |

9M 2017 |

9M 2018 |

||||||||

| 745 | 784 | Net Sales | 2,292 | 2,576 | ||||||||

| 568 | 606 | Cost of goods sold | 1,730 | 1,972 | ||||||||

| 177 | 178 | Gross Profit | 562 | 604 | ||||||||

| 23.8% | 22.7% | Gross Profit % | 24.5% | 23.4% | ||||||||

| 61 | 60 | Selling, General and Administrative | 180 | 186 | ||||||||

| 30 | 29 | Research and Development | 89 | 96 | ||||||||

| 141 | 137 | Adjusted EBITDA* | 458 | 481 | ||||||||

| 143 | 143 | Adjusted EBITDA-ex. hedging impact* | 443 | 514 | ||||||||

| 74 | 73 | Income before taxes | 262 | 293 | ||||||||

| 57 | 929 | Net Income | 237 | 1,137 | ||||||||

| 22 | 19 | Capital Expenditures | 56 | 66 | ||||||||

|

* See reconciliations to the nearest GAAP measure in Appendix. |

||||||||||||

Garrett CEO and President Olivier Rabiller commented, “Garrett delivered a robust quarter, confirming our strong performance in the first nine months of 2018 and the acceleration of our portfolio rebalancing toward gasoline products driven by new launches across the globe. Strong third quarter organic growth of 25% in gasoline sales and 3% organic growth in diesel sales, are well above industry growth rates, and confirm the translation of our strong win rates into net sales. The negative impact on our margin rate of new gasoline growth was mitigated through solid cost control and productivity performance and confirms our expectation that our gasoline business will match our diesel business by the end of 2019. I am pleased that Garrett successfully raised the financing at favorable rates, to become a strong independent company and we look forward to continued advancement in our growth vectors in software and electrification, as we progress towards the start of production of the industry’s first E-Turbo.”

“For the full year 2018, we expect to be between 5% and 6% in organic growth in net sales and between $640 million and $655 million in Adjusted EBITDA, excluding hedging impacts.”

1 Refer to Forward Looking statements and additional disclaimers at the end of this document

Results of operations

Net Sales were $784 million in the third quarter 2018, an increase of $39 million or 5% from $745 million in the third quarter 2017. On an organic basis net sales increased 7% over the third quarter of 2017. The increase was primarily driven by light vehicles OEM products growth of approximately $43 million, along with commercial vehicle growth of $2 million, partially offset by aftermarket and other products decrease of $6 million. The light vehicles product growth was primarily driven by 25% organic growth in light vehicles gasoline products and a 3% organic growth in light vehicles diesel and commercial vehicles products, offset by a 2% organic decline in aftermarket and other products.

For the 9 months ended September 30, 2018, net sales increased $284 million to $2,576 million, or 12% on a reported basis and 7% organically, as compared with the same period in 2017. The increase was primarily driven by $162 million or 27% organic growth in light vehicles gasoline products and a $62 million net sales growth in light vehicles diesel products, which were flat on an organic basis, and a $60 million or 10% organic growth in net sales of commercial vehicle products and a decline in aftermarket and other net sales of $1 million, or 0% organically.

Cost of goods sold was $606 million in the third quarter 2018 and increased by $38 million, or 7% compared with the third quarter 2017 and was primarily driven by an increase in direct material costs due to increased volume. For the first nine months of 2018, cost of goods sold increased $242 million or 14% and was primarily driven by an increase in direct material costs of $204 million due to increased volume.

Gross profit percentage of 22.7% in third quarter 2018 decreased from 23.8% in the third quarter of 2017 primarily due to a 2.7% decline in product mix, partially offset by 2.5% favorable productivity improvement and by favorable volume leverage of approximately 0.5%. For the first nine months of 2018, gross profit percentage decreased by 1.1% due to the unfavorable impacts from mix and price of approximately 2.2 percentage points, partially offset by a favorable volume leverage impact of 0.8 percentage points and net favorable impact from foreign currency translation of approximately 0.4 percentage points.

Selling, general and administrative (SG&A) expenses of $60 million in the third quarter 2018, representing a decrease of $1 million as compared with the third quarter of 2017. For the first nine months of 2018, SG&A increased by $6 million, but declined as a percentage of net sales primarily due to favorable volume leverage.

Research and Development expenses were $29 million in the third quarter of 2018, a decrease of $1 million from the third quarter of 2017 of $30 million. For the first nine months of 2018, R&D expenses increased 8% to $96 million as compared with $89 million in the same period last year.

Other expenses -net of $51 million in the third quarter 2018 increased by $8 million as compared with the third quarter 2017, primarily driven by $6 million increase in environmental charges and $2 million increase in asbestos charges.For the first nine months of 2018, Other expenses – net, increased by $3 million due to an increase in environmental charges of $6 million, partially offset by $3 million decrease in asbestos charges.

Income before taxes was $73 million in the third quarter of 2018 and was in line with the $74 million in the third quarter last year. For the first nine months of 2018, income before taxes increased $31 million to $293 million from $262 million vs the same period in 2017 and was driven by greater volume.

Net income was $929 million for the third quarter 2018 an increase $872 million from the $57 million of net income in the third quarter 2017 and includes an $856 million tax benefit. The third quarter 2018 tax benefit was primarily from internal restructuring of Garrett’s business in advance of the spin-off attributable to currency impacts for withholdings taxes on undistributed foreign earnings, partially offset by adjustments to the provisional tax amount related to the U.S. tax reform. For the first nine months of 2018, net income was $1,137 million, an increase from the $237 million in the nine months in 2017 and was driven by the one-time tax benefit attributable to undistributed foreign earnings.

Capital expenditures were $19 million in the third quarter 2018 as compared with $22 million in the third quarter 2017. For the first nine months of 2018, capital expenditures were $66 million vs $56 million in 2017.

Debt

On September 27, 2018 we entered into a Credit Agreement for senior secured financing of approximately the Euro equivalent of $1,254 million (at inception) consisting of a seven-year senior secured first-lien term B loan facility, which consists of a tranche denominated in Euros of €375 million, and a tranche denominated in U.S. Dollars of $425 million, a five-year senior secured first-lien term A loan in an aggregate principle amount of €330 million and a five-year senior secured first-lien revolving credit facility in an aggregate principal amount of €430 million. On September 27, 2018 we completed the offering of €350 million (approximately $400 million) in aggregate principal amount of 5.125% Senior Notes due 2026. The amounts outstanding on September 30, 2018 were $382 million on Term Loan A, $859 million in Term Loan B and $406 million in Senior Notes, for a total of $1,647 million.

On September 27, 2018 we also entered into a floating-floating cross-currency swap contract to hedge the foreign currency exposure from foreign currency-denominated debt. The contract is designated as a foreign currency fair value hedge for accounting purposes and matures on September 27, 2025. For the three and nine months ended September 30, 2018, gains recorded in Non-operating (income) expense, under the cross-currency swap contract were $13 million. Gains and losses attributable to the cross-currency basis spread of $3 million were deferred to Other Comprehensive Income. The balance of the cross-currency basis spread of $3 million is included in the carrying value of the cross-currency swap contract of $10 million – the application of fair value hedge accounting had no effect on the carrying value of the hedged liability.

Full Year 2018 Outlook

Organic growth in net sales for the full year of 2018 is expected to be in a range from 5%-6%. Adjusted EBITDA for the full year 2018 is expected to be in the range of $640 million - $655 million, excluding the impact of hedging.

Non-GAAP Measures

Adjusted EBITDA decreased to $137 million in the third quarter 2018 as compared with $141 million in the third quarter 2017. Excluding the impact of gains or losses from currency hedging activities, Adjusted EBITDA was unchanged at $143 million in the third quarter of 2017 and 2018.

For the nine months ended September 30, 2018, Adjusted EBITDA increased to $481 million as compared with the same period in 2017. Excluding the impact of gains or losses from currency hedging activities, Adjusted EBITDA increased $71 million, or 16% to $514 million and was primarily driven by greater volume associated with new product launches.

For the nine months ended September 30, 2018, cash flow provided by operations minus capital expenditures was $174 million, representing a decrease of $4 million, or 2%, from the $178 million in the same period of 2017.

Subsequent Events

In connection with the Spin-Off, we also entered into an Indemnification and Reimbursement Agreement with Honeywell on September 12, 2018. As of the Spin-Off date of October 1, 2018, we are obligated to make payments to Honeywell in amounts equal to 90% of Honeywell’s asbestos-related liability payments and accounts payable, primarily related to the Bendix business in the United States, as well as certain environmental-related liability payments and accounts payable and non-United States asbestos-related liability payments and accounts payable, in each case related to legacy elements of the Business, including the legal costs of defending and resolving such liabilities, less 90% of Honeywell’s net insurance receipts and, as may be applicable, certain other recoveries associated with such liabilities. Pursuant to the terms of this Indemnification and Reimbursement Agreement, we are responsible for paying to Honeywell such amounts, up to a cap of an amount equal to the Euro-to-U.S. dollar exchange rate determined by Honeywell as of a date within two business days prior to date of the Distribution (1.16977 USD = 1 EUR) equivalent of $175 million in respect of such liabilities arising in any given calendar year. The payments that we are required to make to Honeywell pursuant to the terms of this agreement will not be deductible for U.S. federal income tax purposes.

On September 12, 2018, we also entered into a Tax Matters Agreement with Honeywell (the “Tax Matters Agreement”), which governs the respective rights, responsibilities and obligations of Honeywell and us after the Spin-Off with respect to all tax matters (including tax liabilities, tax attributes, tax returns and tax contests). The Tax Matters Agreement generally provides that, following the Spin-Off date of October 1, 2018, we are responsible and will indemnify Honeywell for all taxes, including income taxes, sales taxes, VAT and payroll taxes, relating to Garrett for all periods, including periods prior to the completion date of the Spin-Off. Among other items, as a result of the mandatory transition tax imposed by the Tax Cuts and Jobs Act, one of our subsidiaries is required to make payments to a subsidiary of Honeywell in the amount representing the net tax liability of Honeywell under the mandatory transition tax attributable to us, as determined by Honeywell. We currently estimate that our aggregate payments to Honeywell with respect to the mandatory transition tax will be $240 million. Under the terms of the Tax Matters Agreement, we are required to pay this amount in Euros, without interest, in five annual installments, each equal to 8% of the aggregate amount, followed by three additional annual installments equal to 15%, 20% and 25% of the aggregate amount, respectively. In addition, the Tax Matters Agreement addresses the allocation of liability for taxes incurred as a result of restructuring activities undertaken to effectuate the Spin-Off. The Tax Matters Agreement also provides that we are required to indemnify Honeywell for certain taxes (and reasonable expenses) resulting from the failure of the Spin-Off and related internal transactions to qualify for their intended tax treatment under U.S. federal, state and local income tax law, as well as foreign tax law. Further, the Tax Matters Agreement also imposes certain restrictions on us and our subsidiaries (including restrictions on share issuances, redemptions or repurchases, business combinations, sales of assets and similar transactions) that are designed to address compliance with Section 355 of the Internal Revenue Code of 1986, as amended, and are intended to preserve the tax-free nature of the Spin-Off.

We also entered into several additional agreements with Honeywell that govern the future relationship between us and Honeywell and impose certain obligations on us following the Spin-Off, and which may cause us to incur new costs, including the following:

• a Separation and Distribution Agreement;

• a Transition Services Agreement;

• an Employee Matters Agreement;

• an Intellectual Property Agreement; and

• a Trademark License Agreement.

A description of each of these agreements is included in a Current Report on Form 8-K filed with the SEC on October 1, 2018.

On October 19, 2018, Honeywell disclosed in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2018 (the “Honeywell Form 10-Q”) that the Division of Enforcement of the SEC has opened an investigation into Honeywell’s prior accounting for liability for unasserted Bendix-related asbestos claims. In addition, Honeywell noted that it revised certain previously-issued financial statements to correct the time period associated with the determination of appropriate accruals for legacy Bendix asbestos-related liability for unasserted claims. Our restated carve-out financial statements included in our Form 10 already contemplate these revisions, consistent with Honeywell’s previous disclosure in its Form 8-K filed with the SEC on August 23, 2018. The Indemnification and Reimbursement Agreement has not been amended and otherwise remains unchanged. Prior to the filing of the Honeywell Form 10-Q with the SEC, our management was not aware of the SEC’s investigation into Honeywell’s prior accounting.

Forward Looking Statements

This presentation contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of fact, that address activities, events or developments that we or our management intend, expect, project, believe or anticipate will or may occur in the future are forward looking statements including without limitations our statements regarding our anticipated financial performance, projections and explanations regarding our technology solutions. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results or performance of the company to be materially different from any future results or performance expressed or implied by such forward looking statements. Such risks and uncertainties include, but are not limited to those described in our Registration Statement on Form 10 and quarterly report on Form 10Q for the quarter ended September 30, 2018 under such headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements.” You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. Forward looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by our forward-looking statements.

Non-GAAP Financial Measures

This presentation includes LTM (last 12 months) data, Adjusted EBITDA, Adjusted EBIT. Adjusted EBITDA excluding hedging impacts, Net Debt, Consolidated Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA margin excluding hedging impact, Consolidated Adjusted EBITDA Margin, Cash flow from operations minus capital expenditures, and other financial measures not compliant with generally accepted accounting principles in the United States (“GAAP”). The Non-GAAP financial measures provided herein are adjusted for certain items as presented in the Appendix containing Non-GAAP Reconciliations and may not be directly comparable to similar measures used by other companies in our industry, as other companies may define such measures differently. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends. Garrett believes that Adjusted EBITDA, Adjusted EBITDA Margin (both including and excluding hedging impacts), Consolidated Adjusted EBITDA, Consolidated Adjusted EBITDA Margin, Adjusted EBIT are important indicators of operating performance because they exclude the effects of income taxes and certain other expenses, as well as the effects of financing and investing activities by eliminating the effects of interest and depreciation expenses and therefore more closely measures our operational performance. These metrics should be considered in addition to, and not as replacements for, the most comparable GAAP measure. For additional information with respect to our Combined Financial Statements, see our Form 10 and quarterly report on Form 10Q for the quarter ended September 30, 2018.

Additional disclaimers

On October 1, 2018, Garrett Motion Inc. became an independent publicly-traded company through a pro rata distribution by Honeywell International Inc. (“Parent” or “Honeywell”) of 100% of the then-outstanding shares of Garrett to Honeywell’s stockholders (the “Spin-Off”). Each Honeywell stockholder of record received one share of Garrett common stock for every 10 shares of Honeywell common stock held on the record date. Approximately 74 million shares of Garrett common stock were distributed on October 1, 2018 to Honeywell stockholders.

The accompanying Combined Interim Financial Statements reflect the combined historical results of operations, financial position and cash flows of the Transportation Systems Business as they were historically managed in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Therefore, the historical combined financial information may not be indicative of our future performance and does not necessarily reflect what our combined results of operations, financial condition and cash flows would have been had the Business operated as a separate, publicly traded company during the periods presented, particularly because of changes that we have experienced, and expect to continue to experience, in the future as a result of our separation from Honeywell, including changes in the financing, cash management, operations, cost structure and personnel needs of our business.

The asbestos related expenses are presented here on the basis of 100% of the liability payments and will differ from future stand-alone financial statements which will reflect the terms of the Indemnification and Reimbursement Agreement with Honeywell, under which we will be required to make payments to Honeywell in amounts equal to 90% of Honeywell’s asbestos related liability payments and accounts payable, including the legal costs of defending and resolving such liabilities, less 90% of Honeywell’s net insurance receipts and, as may be applicable, certain other recoveries associated with such liabilities.

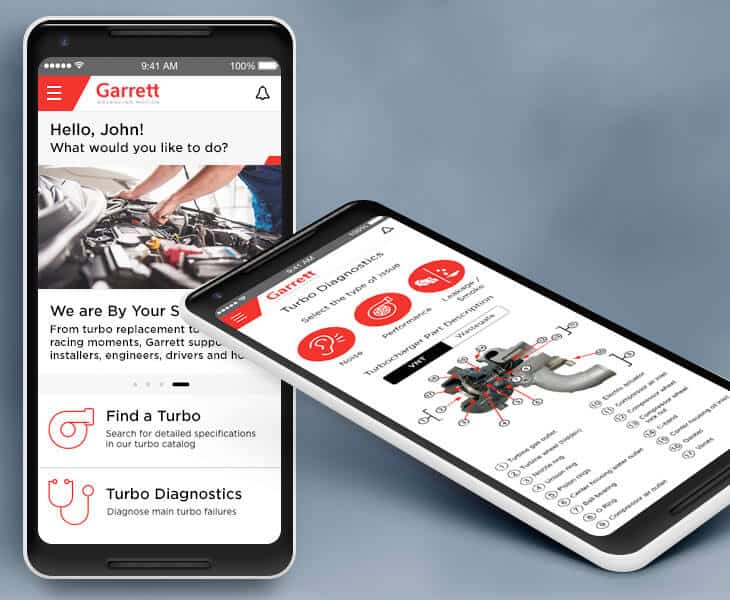

About Garrett

Garrett (www.garrettmotion.com) is a differentiated technology leader, serving customers worldwide for more than 65 years with passenger vehicle, commercial vehicle, aftermarket replacement and performance enhancement solutions. Garrett’s cutting-edge technology enables vehicles to become safer, and more connected, efficient and environmentally friendly. Our portfolio of turbocharging, electric boosting and automotive software solutions empowers the transportation industry to redefine and further advance motion. For more news and information on Garrett, please visit www.garrettmotion.com/news.

|

GARRETT MOTION INC. |

||||||||||||||

|

COMBINED INTERIM STATEMENTS OF OPERATIONS |

||||||||||||||

|

(Unaudited) |

||||||||||||||

|

($ in millions) |

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||

| Net sales | 784 | 745 | 2,576 | 2,292 | ||||||||||

| Cost of goods sold | 606 | 568 | 1,972 | 1,730 | ||||||||||

| Gross profit | 178 | 177 | 604 | 562 | ||||||||||

| Selling, general and administrative expenses | 60 | 61 | 186 | 180 | ||||||||||

| Other expense, net | 51 | 43 | 132 | 129 | ||||||||||

| Interest expense | 1 | 2 | 3 | 5 | ||||||||||

| Non-operating (income) expense | (7 | ) | (3 | ) | (10 | ) | (14 | ) | ||||||

| Income before taxes | 73 | 74 | 293 | 262 | ||||||||||

| Tax expense (benefit) | (856 | ) | 17 | (844 | ) | 25 | ||||||||

| Net income | 929 | 57 | 1,137 | 237 | ||||||||||

|

GARRETT MOTION INC. |

|||||||||

|

COMBINED INTERIM BALANCE SHEETS |

|||||||||

|

(Unaudited) |

|||||||||

| ($ in millions) | September 30, 2018 |

December 31, 2017 |

|||||||

| ASSETS | |||||||||

| Current assets: | |||||||||

| Cash and cash equivalents | 197 | 300 | |||||||

| Accounts, notes and other receivables – net | 762 | 745 | |||||||

| Inventories – net | 183 | 188 | |||||||

| Due from related parties, current | — | 530 | |||||||

| Other current assets | 43 | 321 | |||||||

| Total current assets | 1,185 | 2,084 | |||||||

| Due from related parties, non-current | — | 23 | |||||||

| Investments and long-term receivables | 37 | 38 | |||||||

| Property, plant and equipment – net | 422 | 442 | |||||||

| Goodwill | 193 | 193 | |||||||

| Insurance recoveries for asbestos related liabilities | 162 | 174 | |||||||

| Deferred income taxes | 228 | 41 | |||||||

| Other assets | 63 | 2 | |||||||

| Total assets | 2,290 | 2,997 | |||||||

| LIABILITIES | |||||||||

| Current liabilities: | |||||||||

| Accounts payable | 828 | 860 | |||||||

| Due to related parties, current | 98 | 1,117 | |||||||

| Current maturities of long-term debt | 28 | — | |||||||

| Accrued liabilities | 504 | 571 | |||||||

| Total current liabilities | 1,458 | 2,548 | |||||||

| Long-term debt | 1,577 | — | |||||||

| Deferred income taxes | 22 | 956 | |||||||

| Asbestos related liabilities | 1,516 | 1,527 | |||||||

| Other liabilities | 173 | 161 | |||||||

| Total liabilities | 4,746 | 5,192 | |||||||

| COMMITMENTS AND CONTINGENCIES | |||||||||

| EQUITY (DEFICIT) | |||||||||

| Invested deficit | (2,464 | ) | (2,433 | ) | |||||

| Accumulated other comprehensive income | 8 | 238 | |||||||

| Total deficit | (2,456 | ) | (2,195 | ) | |||||

| Total liabilities and deficit | 2,290 | 2,997 | |||||||

|

COMBINED INTERIM STATEMENTS OF CASH FLOWS |

|||||||||

|

(unaudited) |

|||||||||

| ($ in millions) |

For the Nine Months Ended |

||||||||

| 2018 | 2017 | ||||||||

| Cash flows from operating activities: | |||||||||

| Net income | 1,137 | 237 | |||||||

|

Adjustments to reconcile net (loss) income to net cash provided by operating activities: |

|||||||||

| Deferred income taxes | (908 | ) | — | ||||||

| Depreciation | 53 | 47 | |||||||

| Foreign exchange (gain) loss | 10 | (21 | ) | ||||||

| Stock compensation expense | 16 | 12 | |||||||

| Pension expense | 7 | 7 | |||||||

| Other | 6 | (2 | ) | ||||||

| Changes in assets and liabilities: | |||||||||

| Accounts, notes and other receivables | (42 | ) | (34 | ) | |||||

| Receivables from related parties | 57 | 3 | |||||||

| Inventories | (7 | ) | (37 | ) | |||||

| Other assets | (2 | ) | — | ||||||

| Accounts payable | (6 | ) | (8 | ) | |||||

| Payables to related parties | (50 | ) | (6 | ) | |||||

| Accrued liabilities | (57 | ) | 42 | ||||||

| Asbestos related liabilities | 1 | (5 | ) | ||||||

| Other liabilities | 25 | (1 | ) | ||||||

| Net cash provided by (used for) operating activities | 240 | 234 | |||||||

| Cash flows from investing activities: | |||||||||

| Expenditures for property, plant and equipment | (66 | ) | (56 | ) | |||||

| Proceeds from related party notes receivables | — | 67 | |||||||

| Increase in marketable securities | (21 | ) | (540 | ) | |||||

| Decrease in marketable securities | 312 | 531 | |||||||

| Other | — | 3 | |||||||

| Net cash provided by (used for) investing activities | 225 | 5 | |||||||

| Cash flows from financing activities: | |||||||||

| Net increase (decrease) in Invested deficit | (1,493 | ) | (251 | ) | |||||

| Proceeds from issuance of long-term debt | 1,631 | — | |||||||

| Payments of long-term debt | — | — | |||||||

| Proceeds related to related party notes payable | — | 327 | |||||||

| Payments related to related party notes payable | (493 | ) | (326 | ) | |||||

| Net change related to cash pooling and short-term notes | (201 | ) | 69 | ||||||

| Net cash provided by (used for) financing activities | (556 | ) | (181 | ) | |||||

|

Effect of foreign exchange rate changes on cash and cash equivalents |

(12 | ) | 10 | ||||||

| Net increase (decrease) in cash and cash equivalents | (103 | ) | 68 | ||||||

| Cash and cash equivalents at beginning of period | 300 | 119 | |||||||

| Cash and cash equivalents at end of period | 197 | 187 | |||||||

|

Reconciliation of Net Income to Adjusted EBITDA |

|||||||||||||||||||||||

| For the Three Months | For the Nine Months |

LTM* |

|||||||||||||||||||||

| ($ in millions) | Ended September 30, | Ended September 30, | September 30, | ||||||||||||||||||||

| 2017 | 2018 | 2017 | 2018 | 2018 | |||||||||||||||||||

| Net income (loss) - GAAP | 57 | 929 | 237 | 1,137 | (84 | ) | |||||||||||||||||

| Tax expense | 17 | (856 | ) | 25 | (844 | ) | 480 | ||||||||||||||||

| Profit before taxes | 74 | 73 | 262 | 293 | 397 | ||||||||||||||||||

| Net interest (income) expense | (1 | ) | - | (5 | ) | (3 | ) | (5 | ) | ||||||||||||||

| Depreciation | 17 | 17 | 47 | 53 | 70 | ||||||||||||||||||

| EBITDA (Non-GAAP) | 90 | 90 | 304 | 342 | 462 | ||||||||||||||||||

|

Other operating expenses, net (asbestos and environmental expenses) |

43 | 51 | 129 | 132 | 133 | ||||||||||||||||||

| Non-operating (income) expense | - | - | - | (4 | ) | (3 | ) | ||||||||||||||||

| Stock compensation expense | 4 | 4 | 12 | 16 | 19 | ||||||||||||||||||

| Repositioning charges | 4 | 0 | 13 | 2 | 9 | ||||||||||||||||||

|

Foreign exchange (gain) loss on debt, net of related hedging (gain) loss |

- | (8 | ) | - | (8 | ) | (8 | ) | |||||||||||||||

| Adjusted EBITDA (Non-GAAP) included in Form 10 | 141 | 137 | 458 | 481 | 614 | ||||||||||||||||||

| Adjusted EBITDA % | 19.0 | % | 17.5 | % | 20.0 | % | 18.7 | % | 18.2 | % | |||||||||||||

| Honeywell Indemnity Obligation payment | (44 | ) | (44 | ) | (131 | ) | (131 | ) | (175 | ) | |||||||||||||

| FX Hedging (gain) / loss (net) | 2 | 6 | (16 | ) | 34 | 35 | |||||||||||||||||

| Additional pro forma standalone costs | 2 | - | 3 | (1 | ) | 5 | |||||||||||||||||

| Pro Forma impact on cash paid to customers to be capitalized vs expensed | 2 | - | 7 | - | 2 | ||||||||||||||||||

| Oher non-recurring, non-cash expense | 2 | - | 1 | 0 | 27 | ||||||||||||||||||

| Consolidated EBITDA | 105 | 100 | 324 | 383 | 505 | ||||||||||||||||||

| Add. Honeywell Indemnity Obligation Payment | 44 | 44 | 131 | 131 | 175 | ||||||||||||||||||

| Consolidated EBITDA (Non-GAAP, excl. Honeywell indemnity obligation | 148 | 143 | 455 | 514 | 680 | ||||||||||||||||||

| Consolidated EBITDA % margin (Non-GAAP, excl. Honeywell indemnity obligation) | 19.9 | % | 18.3 | % | 19.8 | % | 20.0 | % | 20.1 | % | |||||||||||||

| * LTM or last 12 months | |||||||||||||||||||||||

|

Reconciliation of Adjusted EBITDA Minus Capital Expenditures as % Adjusted EBITDA |

|||||||||||||||||||||

|

($ in millions) |

|||||||||||||||||||||

| 3 months ended | 3 months ended | 9 months ended | 9 months ended | ||||||||||||||||||

| September 30, 2018 | September 30, 2017 | September 30, 2018 | September 30, 2017 | ||||||||||||||||||

| Adjusted EBITDA | $ | 137 | $ | 141 | $ | 481 | $ | 458 | |||||||||||||

| CAPEX (Expenditures for property, plant and equipment) | ($19 | ) | ($22 | ) | ($66 | ) | ($56 | ) | |||||||||||||

| Adjusted minus CAPEX | $ | 118 | $ | 119 | $ | 415 | $ | 402 | |||||||||||||

| ÷ Adjusted EBITDA | 86 | % | 84 | % | 86 | % | 88 | % | |||||||||||||

|

Reconciliation of Net Income to Adjusted EBIT |

|||||||||||||||||||||||

| For the Three Months | For the Nine Months |

LTM* |

|||||||||||||||||||||

| Ended September 30, | Ended September 30, | September 30, | |||||||||||||||||||||

| ($ in millions) | 2017 | 2018 | 2017 | 2018 | 2018 | ||||||||||||||||||

| Net income (loss) - GAAP | 57 | 929 | 237 | 1,137 | (84 | ) | |||||||||||||||||

| Tax expense | 17 | (856 | ) | 25 | (844 | ) | 480 | ||||||||||||||||

| Profit before taxes | 74 | 73 | 262 | 293 | 397 | ||||||||||||||||||

| Net interest (income) expense | (1 | ) | - | (5 | ) | (3 | ) | (5 | ) | ||||||||||||||

| EBIT (Non-GAAP) | 73 | 73 | 258 | 289 | 392 | ||||||||||||||||||

| Other operating expenses, net (asbestos and environmental expenses) | 43 | 51 | 129 | 132 | 133 | ||||||||||||||||||

| Non-operating (income) expense | - | - | - | (4 | ) | (3 | ) | ||||||||||||||||

| Stock compensation expense | 4 | 4 | 12 | 16 | 19 | ||||||||||||||||||

| Repositioning charges | 4 | 0 | 13 | 2 | 9 | ||||||||||||||||||

| Foreign exchange (gain) loss on debt, net of related hedging (gain) loss | - | (8 | ) | - | (8 | ) | (8 | ) | |||||||||||||||

| Adjusted EBIT | 125 | 120 | 411 | 427 | 542 | ||||||||||||||||||

| Adjusted EBIT% | 16.7 | % | 15.2 | % | 17.9 | % | 16.6 | % | 16.0 | % | |||||||||||||

| * LTM or last 12 months | |||||||||||||||||||||||

|

Reconciliation of Organic Sales % Change |

||||||||||||||||||||

| 3 months ended | 3 months ended | 9 months ended | 9 months ended | |||||||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||||||||||||||

|

Reported sales % change |

5 | % | 5 | % | 12 | % | 1 | % | ||||||||||||

| Less: Foreign currency translation | (1 | %) | 2 | % | 5 | % | (1 | %) | ||||||||||||

| Organic sales % change | 7 | % | 3 | % | 7 | % | 2 | % | ||||||||||||

| Gasoline | ||||||||||||||||||||

| Reported sales % change | 23 | % | 8 | % | 34 | % | 6 | % | ||||||||||||

| Less: Foreign currency translation | (1 | %) | 2 | % | 7 | % | (1 | %) | ||||||||||||

| Organic sales % change | 25 | % | 6 | % | 27 | % | 7 | % | ||||||||||||

| Diesel | ||||||||||||||||||||

| Reported sales % change | 2 | % | -9 | % | 6 | % | (10 | %) | ||||||||||||

| Less: Foreign currency translation | (1 | %) | 3 | % | 7 | % | (1 | %) | ||||||||||||

| Organic sales % change | 3 | % | (12 | %) | (0 | %) | (10 | %) | ||||||||||||

| Commercial vehicles | ||||||||||||||||||||

| Reported sales % change | 1 | % | 45 | % | 14 | % | 5 | % | ||||||||||||

| Less: Foreign currency translation | (1 | %) | 0 | % | 3 | % | (21 | %) | ||||||||||||

| Organic sales % change | 3 | % | 44 | % | 10 | % | 27 | % | ||||||||||||

| Aftermarket and other sales | ||||||||||||||||||||

| Reported sales % change | (3 | %) | 1 | % | 1 | % | 1 | % | ||||||||||||

| Less: Foreign currency translation | (1 | %) | 2 | % | 3 | % | 0 | % | ||||||||||||

| Organic sales % change | (2 | %) | (1 | %) | (2 | %) | 1 | % | ||||||||||||

|

Reconciliation of cash provided by operations minus CAPEX |

||||||||||||

|

($ in millions) |

||||||||||||

| 9 months ended | 9 months ended | |||||||||||

|

September 30, |

September 30, |

|||||||||||

| Net cash provided by (used for) operating activities | $ | 240 | $ | 234 | ||||||||

| Expenditures for property, plant and equipment (CAPEX) | ($66 | ) | ($56 | ) | ||||||||

| Net cash from operating activities minus CAPEX | $ | 174 | $ | 178 | ||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20181106005501/en/

MEDIA

Mike Stoller

+1 734 392-5525

michael.stoller@garrettmotion.com

or

INVESTOR RELATIONS

Paul Blalock

+1 862 812-5013

paul.blalock@garrettmotion.com

Source: Garrett Motion Inc.