ROLLE, Switzerland--(BUSINESS WIRE)--Garrett Motion Inc. (“Garrett”) today announced that it has received an improved stalking horse bid from KPS Capital Partners, LP (“KPS”) with respect to a potential purchase of its business. The Company is continuing with its competitive bidding process, and seeking approval of bidding procedures and stalking horse bid protections from the bankruptcy court.

Garrett also responded today to an October 16, 2020, non-binding proposal from a group of institutional investors and Honeywell International Inc. that the Company sell control to the institutional investors without a further marketing process.

Improved Stalking Horse Bid From KPS

On September 20, 2020, Garrett and certain affiliates of KPS entered into a share and asset purchase agreement (the “Purchase Agreement”) in connection with the proposed purchase of Garrett’s business. The purchase would be implemented through voluntary Chapter 11 cases with the United States Bankruptcy Court for the Southern District of New York also commenced by Garrett and certain of its subsidiaries on September 20, 2020 (In re: Garrett Motion, Inc., et al., No. 20-12212 (MEW) (Bankr. S.D.N.Y.).

Under the terms and conditions of the revised stalking horse bid received from KPS:

- KPS would increase the base purchase price for the Garrett business by $500 million, from $2.1 billion to $2.6 billion (in each case subject to adjustment as provided in the Purchase Agreement). KPS would also purchase an entity that directly holds (and after the closing will retain) the claims of Garrett and its affiliates against Honeywell International Inc. in connection with the disputed subordinated asbestos indemnity agreement and tax matters agreement.

- Upon completion of the sale, KPS would list the new parent company on a recognized U.S. stock exchange.

- KPS would make available to existing Garrett stockholders an equity co-investment opportunity on the same economic terms as KPS, allowing Garrett stockholders to continue to hold shares in the publicly-listed reorganized business. KPS would offer co-investment in an aggregate amount of up to $350 million, $100 million of which would be available to all shareholders on a pro rata basis. KPS has indicated that it expects existing shareholders would own approximately 24% of outstanding common equity assuming maximum co-investment (subject to adjustment).

- The anticipated dates for Garrett’s competitive process would be extended to provide Garrett with additional time to assess higher or better offers. The anticipated auction date would be December 18, 2020 rather than November 24, 2020, with other dates adjusted accordingly.

The revised bid from KPS is conditioned on court approval of Garrett’s proposed bidding procedures. The Purchase Agreement would remain subject to higher or better offers in the bankruptcy case. Closing of the transaction is subject to customary regulatory approvals, as well as court approval and other customary conditions. Following court approval of Garrett’s proposed bid procedures, Garrett would work with KPS to amend the Purchase Agreement and other transaction documentation to reflect the terms of the revised bid.

Alternative Proposal Would Discontinue Auction and Sell Control to Certain Institutional Investors

On October 16, 2020, Honeywell International Inc., Centerbridge Partners, L.P. and Oaktree Management L.P. (collectively, the “Bidding Group”) publicly announced that they had entered into a coordination agreement in anticipation of submitting to Garrett an alternative proposal for a plan of reorganization (the “Alternative Proposal”). Garrett received a letter on behalf of the Bidding Group regarding the Alternative Proposal after the public announcement.

The Alternative Proposal was prepared with public information only and had not been negotiated with Garrett. It followed invitations from Garrett to the members of the Bidding Group to join the competitive process alongside other bidders. Garrett understands that the terms of the Alternative Proposal prohibit any participating parties from discussing alternative transactions with Garrett or other third parties during the bankruptcy case. The Alternative Proposal also requests that Garrett agree to stop the competitive process altogether and not seek, solicit or support any alternative to the Alternative Proposal.

The substantive terms of the Alternative Proposal also include a settlement with Honeywell, the cash sale of virtually all equity value of Garrett to the institutional investors party to the Alternative Proposal and special participation rights offered to select institutional investors in return for their support of the Alternative Proposal.

Garrett responded to the Bidding Group today by raising initial questions about the content of the Alternative Proposal, including its impact on the competitive process, the availability and terms of financing and its treatment of remaining Garrett stockholders. Garrett again invited the members of the Bidding Group to participate in what is intended to be an ongoing competitive process, and Garrett intends to continue discussions with the Bidding Group regarding the Alternative Proposal as well.

Information about the Chapter 11 Process

Garrett anticipates emerging from Chapter 11 and completing the sale process in early 2021.

Morgan Stanley & Co. LLC and Perella Weinberg Partners are serving as financial advisors, Sullivan & Cromwell LLP and Quinn Emanuel Urquhart & Sullivan LLP are serving as legal advisors, and AlixPartners are serving as restructuring advisor to Garrett Motion.

Court filings and other documents related to the Chapter 11 process are available at http://www.kccllc.net/garrettmotion or by calling Garrett’s claims agent, KCC, at 866-812-2297 (U.S. toll-free) or +800 3742 6170 (international toll-free) or sending an email to Garrettinfo@kccllc.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of fact, that address activities, events or developments that we or our management intend, expect, project, believe or anticipate will or may occur in the future are forward-looking statements including without limitation our statements regarding our Chapter 11 process and the ongoing competitive process. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results or performance of the company to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to those described in our annual report on Form 10-K for the year ended December 31, 2019, as updated by our quarterly report on Form 10-Q for the period ended June 30, 2020, as well as our other filings with the Securities and Exchange Commission, under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements.” You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. Forward-looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by our forward-looking statements.

About Garrett Motion Inc.

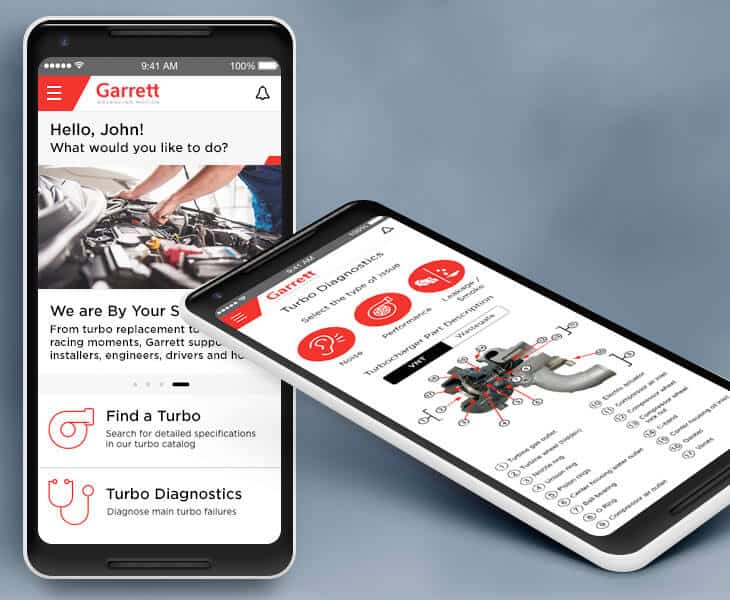

Garrett Motion is a differentiated technology leader, serving customers worldwide for more than 65 years with passenger vehicle, commercial vehicle, aftermarket replacement and performance enhancement solutions. Garrett’s cutting-edge technology enables vehicles to become safer, and more connected, efficient and environmentally friendly. Our portfolio of turbocharging, electric boosting and automotive software solutions empowers the transportation industry to redefine and further advance motion. For more information, please visit www.garrettmotion.com.