Garrett Motion Exploring Alternatives for Balance Sheet Restructuring

ROLLE, Switzerland--(BUSINESS WIRE)-- Garrett Motion Inc. (NYSE: GTX), a cutting-edge technology provider that enables vehicles to become safer, more connected, efficient and environmentally friendly, today announced that, with the assistance of its financial and legal advisors, it is exploring alternatives for addressing its previously disclosed balance sheet concerns.

On June 12, 2020, Garrett entered into an amendment to its credit agreement to obtain relief from certain financial covenants, including the consolidated leverage ratio, in light of current and anticipated operating conditions. However, as disclosed in Garrett’s quarterly report on Form 10-Q for the three months ended June 30, 2020, notwithstanding the relief provided by the credit agreement amendment, Garrett’s leverage ratio remains high and we expect will remain so for at least the next several quarters. Garrett’s leveraged capital structure poses significant challenges to its overall strategic and financial flexibility and may impair its ability to gain or hold market share in the highly competitive automotive supply market, thereby putting Garrett at a meaningful disadvantage relative to its peers.

In addition, Garrett’s high leverage is exacerbated by significant claims asserted by Honeywell against certain Garrett subsidiaries under the disputed subordinated asbestos indemnity and the tax matters agreement. These arrangements were a part of an inappropriate capital structure imposed by Honeywell on Garrett as part of its 2018 spin-off that has proven ill-suited to cope with any meaningful challenges at the macroeconomic level, much less those Garrett faces amid a global pandemic. As previously disclosed, payment on the disputed claims by Honeywell has been generally deferred until the second quarter of 2023, but the possibility of the disputed claims being payable in the future – combined with Garrett’s high leverage and competitive situation – create a substantial additional overhang on Garrett’s balance sheet and impede Garrett’s access to capital and its ability to execute its strategy. As a result, Garrett sees a substantial risk that it will not be able to distribute value to its stockholders in the future, despite its strong operating performance and compelling business prospects.

Garrett is seeking to address its balance sheet concerns while its core business remains strong in order to preserve the resources necessary to provide exceptional service to its customers, be a reliable partner to its suppliers and other stakeholders, and act as a stable and desirable employer. Garrett has ample liquidity to support its current and future commitments to customers, suppliers, employees and other business partners without interruption, with available cash and undrawn revolver capacity totaling $482 million as of June 30, 2020.

Despite the near-term disruption to the automotive industry and the global economy from COVID-19 and the company’s over-levered capital structure, Garrett has continued its track record of operational excellence. However, Garrett believes the business must take important steps to maintain its leadership position in light of industry headwinds. In particular, coming out of this crisis, automakers will likely encounter even tougher emission reduction targets and technical challenges that will require new technology to be developed and funded by the major auto suppliers. At the same time, the industry also faces continued uncertainties over the longer-term impact of the pandemic, as well as risk of other similar macroeconomic shocks.

We believe that Garrett, with a restructured balance sheet and improved financial flexibility, will be uniquely positioned to bring customers the cutting-edge technologies and required solutions to benefit fully from a global regulatory environment driving future vehicle development. Additionally, Garrett will have the ability to invest to further strengthen its position as a market leader in turbocharger technology and expand its presence in the electric software and automotive software markets.

Garrett has not yet determined whether to pursue any balance sheet restructuring alternatives. However, any actions taken by Garrett in relation to liability management may materially reduce the value or trading price of our common stock, dilute existing holders of our common stock by the issuance of equity (whether through conversion of existing liabilities into equity or otherwise), or result in the cancellation of existing common stock. There can be no assurance that recoveries in any restructuring will approximate current trading prices of Garrett’s securities.

About Garrett

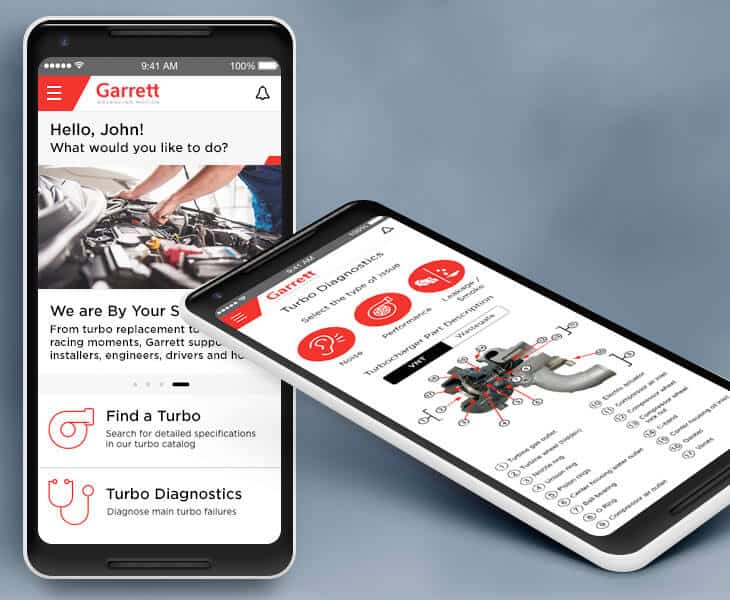

Garrett (www.garrettmotion.com) is a differentiated technology leader, serving customers worldwide for more than 65 years with passenger vehicle, commercial vehicle, aftermarket replacement and performance enhancement solutions. Garrett’s cutting-edge technology enables vehicles to become safer, and more connected, efficient and environmentally friendly. Our portfolio of turbocharging, electric boosting and automotive software solutions empowers the transportation industry to redefine and further advance motion. For more news and information on Garrett, please visit www.garrettmotion.com/news.

Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of fact, that address activities, events or developments that we or our management intend, expect, project, believe or anticipate will or may occur in the future are forward-looking statements including without limitation our statements regarding the anticipated impact of the COVID-19 pandemic on our business, financial results and financial condition, expectations regarding global automotive demand and execution of our strategy. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results or performance of the company to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to risks related to the COVID-19 pandemic and its impact on our business, financial results and financial condition, risks related to our debt and those risks described in our annual report on Form 10-K for the year ended December 31, 2019, as updated by our quarterly report on Form 10-Q for the period ended June 30, 2020, as well as our other filings with the Securities and Exchange Commission, under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements.” You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. Forward-looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by our forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200826005371/en/

Mike Stoller

Garrett Motion

+1 734-392-5525

michael.stoller@garrettmotion.com

Source: Garrett Motion Inc.